Finding value in UK equities

Amid the challenges facing the market, what is the outlook for investors in UK equities?

Several factors over the years have caused the UK equity market to be unloved.

And as the UK continues to face a somewhat uncertain economic future – although inflation appears to be on a downward trajectory – where is the value in UK equities for investors and can these types of assets fit into a portfolio?

This report is worth 30 minutes of CPD.

Adviser attitudes towards UK equities mixed

Adviser attitudes towards UK equities over the next 12 months are mixed, according to the latest FTAdviser Talking Point poll.

Advisers were asked: "what is your sentiment towards UK equities over the next six to 12 months?"

Around one in ten (11 per cent) said it was completely negative, while 29 per cent responded that it was somewhat negative.

Some 15 per cent said their sentiment was completely positive, with 29 per cent responding that it was somewhat positive.

Meanwhile, 15 per cent said it was neither negative nor positive.

Philip Dragoumis, director and owner at Thera Wealth Management, says: “As we run an evidence-based investment strategy for clients, we believe that the sum of all global capital flows should determine client geographical allocations.

“UK equities currently make up around 3.8 per cent of the FTSE All world index, hence this is also our preferred allocation for the equity portion of client portfolios.

“Any increase to this weighting means that we are making an active bet that the UK market will outperform the rest of the world. We don't believe we have enough of an edge to make this call and we would argue that the evidence suggests nobody else does either.”

Meanwhile, Gary Bush, financial adviser at Mortgage Shop, says: “Our opinion on UK equities is that they present a good medium to long-term outlook, barring the fact that the next global crisis isn't queuing up waiting in the wings.”

ima.jacksonobot@ft.com

Outlook for UK equities

The UK equities market has experienced a difficult number of years, which has caused investors to lose confidence in the market.

Key events that have led to this include Brexit and political uncertainty, plus the fact that the makeup of the UK stock market is seen as being in old-fashioned sectors, not high-growth areas such as technology.

That left UK companies very much unloved on a global basis.

Another factor is that the UK market has underperformed the global market, and as the market has underperformed, investors have reallocated from the UK, causing it to continue to underperform.

But is there still value to be found in UK equities?

Opportunity for investors

Sophie Lund-Yates, lead equity analyst at Hargreaves Lansdown, says that while the UK equity market is in “an incredibly difficult position”, it does offer nuggets of opportunity within the “beaten-up” financial sector.

She adds: “It also has some strong consumer-facing names that are well placed to weather the incoming economic storm, especially those on the logistics and distribution side of things like big box warehouses with high calibre customers, and fast-moving consumer goods and e-commerce-facing packaging giants all offer resilience in my opinion.”

Describing the UK equity market as being in a “sorry state”, Darius McDermott, managing director of Chelsea Financial Services, notes UK equities have severely underperformed the US and global equities over a medium and long time frame.

“Even in the past couple of years, when the value style has done better due to higher interest rates and inflation, the S&P 500 has still beaten the UK by more than 5 per cent,” McDermott adds.

“The UK is dominated by old world stocks and is struggling to attract newer businesses that might inject some life into it."

He says the UK also shot itself in the foot; by encouraging pension funds to divest from UK equities it has severely weakened the UK stock market.

UK equities have some strong consumer-facing names that are well placed to weather the incoming economic storm

McDermott adds: "Unsurprisingly, companies, even British companies like [chip designer] Arm, are now looking to list elsewhere where there is a greater pool of natural equity buyers.

“More recently, the UK has shot itself in the foot again. One of the few bright spots in the UK over the past few years has been the investment trust market. Many new trusts have launched, offering investors everything from song royalties to wind farms.

“Sadly new cost rules (which in our view are misleading and wrong) have forced many investors to reduce their investment trust holdings. With most investment trusts now trading on huge discounts, there is no prospect of any new trusts listing any time soon.”

Valuations

However this, McDermott notes, does not mean the UK is a bad investment today: “In fact, the reason some stocks are looking at de-listing is precisely because there is a feeling the UK market is undervaluing them, which means there may be good potential returns for investors.”

Scott Gallacher, director of Rowley Turton, says while the low price to earnings (P/E) ratio means investors are still pessimistic about the prospects for UK companies and their share prices, investors can be wrong, adding there is scope for UK businesses to surprise the market.

“Today’s low P/E ratios mean that if good profits and growth do materialise from UK companies, then the UK stock market could deliver a significant positive return simply from a re-rating,” Gallacher adds.

“A lower P/E ratio for the FTSE All Share index (11.6) compared to the S&P 500 (20.34) suggests that, at least based on this metric, UK equities may be relatively undervalued compared to US equities.

“However, it's essential to consider other factors as well, such as earnings growth prospects, industry trends, and macroeconomic conditions."

Additionally, Leigh Himsworth, portfolio manager of the Fidelity UK Opportunities Fund, says that as CPI has fallen back to just short of 7 per cent (6.7 per cent as of September 20), “all of a sudden” equities are beginning to rediscover their appeal.

Further, Himsworth says he believes UK markets remain healthy at the very least on a relative basis versus peers.

He points to recent data from Peel Hunt, which shows the FTSE All-Share stands on a forward price per earnings multiple of 12.1x forecast growth of 6.8 per cent and a median yield of 4.2 per cent – growth and yield adding up to 11 per cent.

The reason some stocks are looking at de-listing is precisely because there is a feeling the UK market is undervaluing them

Himsworth says the latter point is important, as this time last year the market offered little in the way of growth and so yield alone at just over 4 per cent stood well below CPI at 11.1 per cent.

He adds: “This ‘taming’ of inflation is helping, but bond yields need to keep falling as treasuries still offer attractive returns with gross redemption yields still beating 5 per cent, at least.

“It is also useful to break down the earnings growth number. I use the median, as this strips out the skews of the largest companies.

"Following on from post-Ukraine spikes, the large energy and mining companies are seeing forecast earnings fall over the next year, which, as these generate their earnings largely from overseas, implies that more UK-focused companies are the ones likely to generate the returns.”

UK smaller companies

Despite some of the challenges with the UK equities market, the UK smaller companies market is expected to generate better returns for investors.

McDermott says while UK small caps have been “left for dead”, there is a lot of potential value there which will be realised when sentiment turns more positive.

He adds: “UK smaller companies have done much better than large caps over the past 20 years and you do get a lot of very interesting UK smaller companies with good growth potential. We think this area will recover at some point.

“There is value across the UK market in all sectors relative to global peers. Even if you want to avoid areas like oil, banks or mining, there is still a discount in a business like Diageo relative to its global peers and the same is true of virtually all sectors.

“We also see tremendous value in the investment trust space at the moment where there are huge discounts and large dividend yields – although for full disclosure we own many investment trusts for the VT Chelsea Managed funds we advise on.”

Himsworth says: “Mid and smaller cap companies look highly appealing, especially if, as bond yields drop further, the market looks for its returns increasingly from growth again.”

While inflation is likely to remain ‘elevated’, Himsworth says UK equities seem to be following the lead of the US markets and nudging themselves back to looking for earnings growth: “This should push us back towards mid and small caps and the nimbler businesses.”

Additionally, as China appears to have struggled to gain momentum after emerging from Covid-19 lockdowns, this has left investors to both seek returns elsewhere and avoid those related to problems from the Far East.

Economies such as France via luxury goods and Germany via its cars and high-end machine tools have struggled; Germany in particular, as the car manufacturers have slowed significantly.

Himsworth says: “The UK being a little more tilted to the US has benefitted from the US being one of the first countries to emerge from Covid-19 and so its economy has gathered some momentum, but more importantly has been given industrial impetus from the Inflation Reduction Act (IRA) and Chips Act that have both given a huge boost to related businesses, many of which UK industrials are enjoying the benefit from.

“Within UK financials, there is a split between the larger stocks such as banks that perform well as bond yields rise versus those smaller businesses who thrive on asset markets and net asset values. This means that real estate offers substantial value (where not structurally impaired) as do some of the small wealth/asset managers.”

UK smaller companies have done much better than large caps over the past 20 years and you do get a lot with good growth potential

Building a portfolio

When it comes to how UK equities fit into a portfolio, Gallacher says it can serve as a valuable component of a diversified investment portfolio, helping to spread risk.

Gallacher adds: “The UK equities sector is diverse, with companies representing various industries and market capitalisations. Investors often use UK equities for income, capital growth, or a combination of both.

“That said, it has historically been viewed as a ‘value’ market rather than a ‘growth’ market and lacks the high-tech high growth companies of the US market.”

McDermott says while the level of diversity is much reduced at the large cap end of the spectrum – the UK is dominated by old world stocks like oil companies, miners, and banks – he sees value in UK small caps.

He adds: “The UK famously has little in the way of technology. You definitely wouldn't want to have all your investments in the UK. That said, given current valuations, we like the UK and we particularly like UK small caps for the long term.”

Looking ahead, the continued delisting of companies away from the UK could affect investor sentiment and market perception.

McDermott says there is a network effect with stock markets.

“Losing companies will mean losing trading volumes, losing relevance and make it even harder to attract new listings. It will make it easier for global fund managers to ignore the UK.”

The economy

Inflation seemingly reducing, the recent monthly fall in GDP and interest rates rising will have varying effects on different parts of the UK equities sector.

Higher inflation is likely to cause it to outperform the rest of the world. This is mainly because of its large overweight in energy and mining companies that benefit from the higher commodity prices that usually come with high inflation.

McDermott says: “The UK is a bit of a strange market…High inflation also means higher nominal growth, meaning growth is less scarce. This benefits a value market like the UK versus a growth market.

“Higher rates can also help banks and insurers to make higher profits, although this is more mixed as higher rates can sometimes hurt banks as well. Overall, I would expect lower inflation to be bad for the UK on a relative basis, however only large caps not small caps.

The political parties of all colours should unite to agree on a shared long-term economic strategy

“The UK market as a whole is dominated by its large multi-nationals, so UK GDP is relatively unimportant to it. Lower inflation and lower rates are likely to have a much more positive impact on small and mid caps and might cause them to outperform their large-cap peers.”

According to Gallacher, a slowing GDP growth rate may also affect corporate earnings.

However, the relationship between these factors is complex, and it is essential to consider them in the context of the broader economic landscape.

Reinvigorating UK equities

While an established and trusted market, the recent increases to corporation tax will have reduced the UK’s attractiveness for listing.

This, along with seemingly a lack of a long-term focus or industrial/economic strategy by successive governments, hindered by years of internal conflict over Brexit and how it should look, Gallacher says he cannot see a reinvigoration of the UK equities market on the horizon.

He adds: “The political parties of all colours should unite to agree on a shared long-term economic strategy that we can all work towards. However, I cannot see this happening due to our first-past-the-post system.”

According to McDermott, there are steps the government can take to help reinvigorate the UK equities market, such as:

- Encouraging UK pensions to invest a little more in equities.

- Making it easier for companies to list.

- Abolishing the misleading cost disclosure rules for investment trusts.

- Abolishing stamp duty on shares.

- Supporting more venture capital in the UK to allow new companies to come through.

The Capital Markets Industry Taskforce has commissioned a report to be published this autumn on how to rejuvenate the UK’ capital market.

The work is being carried out by a group led by Nigel Wilson, former group chief executive of Legal and General.

ima.jacksonobot@ft.com

McDermott: the UK is dominated by old world stocks like oil companies, miners, and banks.

McDermott: the UK is dominated by old world stocks like oil companies, miners, and banks.

Himsworth: UK markets remain healthy at the very least on a relative basis versus peers.

Himsworth: UK markets remain healthy at the very least on a relative basis versus peers.

Gallacher: UK equities can serve as a valuable component of a diversified investment portfolio.

Gallacher: UK equities can serve as a valuable component of a diversified investment portfolio.

McDermott: there are steps the government can take to help reinvigorate the UK equities market.

McDermott: there are steps the government can take to help reinvigorate the UK equities market.

Five of the best: UK sector leaders for tough times

It is hard to find a developed country where the pressures facing business are collectively more acute than they are in the UK.

We single out five companies that we think are better placed to cope than most.

Businesses in the UK, and globally, have had to deal with many headwinds and forces of change in the past few years.

After nearly a decade and a half of zero interest rate policy, and now in the face of rapidly rising costs, many companies are having to reassess their business strategies amid a major shift in the economic regime.

You will quite often hear companies complain of the rising cost of doing business – and they are not wrong. Interest rates are much higher, and hence so is the cost of capital. In addition, labour shortages are commonplace, as is high staff turnover.

Meanwhile, companies are also facing rising costs of materials and goods, coupled with limited supplies. To add to all of the above, tax rates are much higher than they were just a few years ago.

As a result of these changes, the barriers to compete and operate in many industries continue to rise. And we have not even mentioned generative artificial intelligence, ever-more complex regulations and the need to invest in sustainability.

More competitive landscape – potentially good for industry leaders

The barriers to entry in many industries are rising rapidly, and are higher than at any time that we can remember in our 20-plus years of investing.

In fact, it is harder to find a developed country where these pressures are collectively more acute than they are in the UK.

From our perspective as long-term investors, we do not necessarily see tough corporate times as a bad thing.

We spend our days identifying and meeting management teams of the well-funded industry leaders with the scale and profitability to overcome such challenges.

The advantages of such companies are now becoming more apparent as the rising cost of doing business, and cost capital in particular, drive industry shake-outs and lessen “competitive intensity”.

In many industries, competitive intensity is falling from high levels after zero interest rate policy had favoured the challenger or maverick business models for so long.

In this vein, we highlight leading companies from five completely different industries, spanning travel and leisure, retail, house-building, construction and real estate.

For each of these industries we have identified the leaders within them that we think are benefitting from the current environment.

The highlighted companies typically have a particularly strong culture and the advantage of management teams with longer-term vision and patience.

1. Travel and leisure

The hotel group: Whitbread plc

The hotel industry in the UK has been through a particularly difficult time in recent years for obvious reasons.

There are a number of large hotel groups, but much less so outside of London and the major cities. Premier Inn, Whitbread’s core asset, competes with larger groups such as Travelodge outside the large city market, but the majority of the market is occupied by independent hotel chains/individual owners.

Whitbread, we believe, is experiencing a reduction in competitive intensity as some of the independent hotel groups shrink for lack of funding.

On the other side of the equation, new hotel openings are very limited. In the past two years, data we have seen from UBS Evidence Lab suggests the competitive intensity has fallen for Premier Inn if we measure it in terms of number of competitors within a 10-minute drive.

This is allowing Premier Inn more scope to grow and invest. In fact, not only is Whitbread investing heavily in its hotels in both the UK and Germany, but it can also afford a generous share buyback and dividend to boot.

The result is a YouGov brand index score that is unrivalled in the industry.

2. Retail

The clothing and household goods retailer: Next plc

Next operates in a highly competitive space where barriers to entry have historically been low (plenty of retail space available and many Eastern-based clothing manufacturers).

The shift to online shopping has decimated the high street and many retailers and brand owners have failed to make the leap online in a profitable way.

Next has done this very successfully, helped by the fact that the old Next Direct business was in fact an e-commerce business from the outset, with the logistics infrastructure and knowhow to operate in a post-high street world.

Astute brand management and investment from chief executive Lord Simon Wolfson over the past 20-plus years has allowed Next to not only take more market share, but a much higher share of the value chain of the competition.

There is Next the brand and then there is Next the total platform, which offers infrastructure, systems and technology to other consumer brands that do not have the resources or scale to operate in a world of digital shopping.

The recent cost of living squeeze, the rapidly rising cost of funding, the abundance of global supply chain issues, and the sharp increase in supply chain standards (eg Leicester sweat-shop allegations) are making the barriers to compete ever higher to climb.

It is no surprise to us that the market share of the Next brand continues to grind upwards versus its key competitors. It is also no surprise to us that Next recently increased its profit guidance for 2023.

3. House-building

The London-focused house-builder: Berkeley Group Holdings

When it comes to the UK house-building industry there are almost two separate markets: one inside the M25 encompassing London and one outside it.

The mix of buyers, the labour pool, and regulations (land scarcity, mostly brownfield sites) are quite different.

The business of planning, developing and selling in London is in many ways more complex than anywhere else in the country.

For this reason, we see a limited presence in the London market from the large listed builders, who tend to focus their sights on the regions.

Berkeley is the largest builder operating in London, with an historic share of about 12 per cent, competing mainly against a long tail of private builders.

Following the fallout of the Grenfell Tower tragedy, the rise in politics around building standards has led to the unintended consequence of a sharp contraction in the number of new apartments being built/planned in the City.

Housing starts are a fraction of government targets in the capital.

Berkeley has a fantastic track record of buying and developing land at the right times in the cycle, and has the enviable position of sitting on 12-plus years of a land bank with unrivalled expertise in the complex brownfield planning process.

Recently, the group’s share of starts has shot up because of others retrenching.

Peer house-builders in London tend to operate with much shorter land banks, and with funding so tight, supply is likely to be severely constrained in the coming years.

The return of the international buyer (about 50 per cent of Berkeley’s unit sales) following the pandemic is also a support for demand in a world of high mortgage rates.

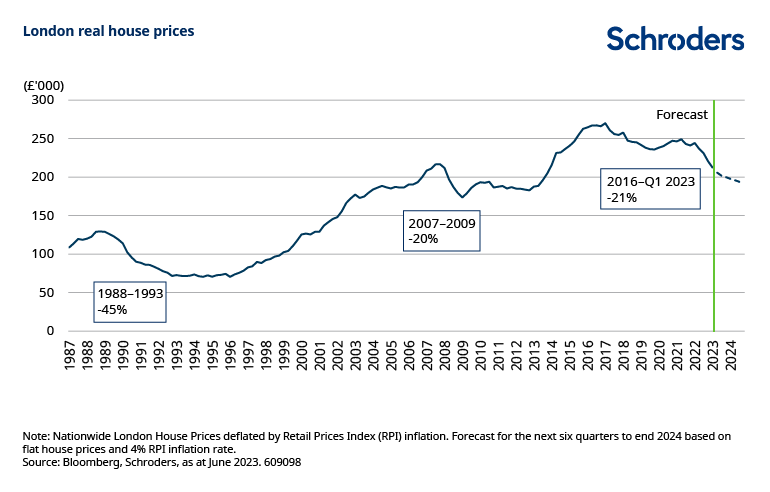

With a backdrop of tighter supply, it is interesting to note that when adjusted for inflation, the “real” price of a house in London has fallen 21 per cent since 2016, already worse than what occurred in the financial crisis of 2008-09.

Assuming flat house prices until the end of 2024, and a 4 per cent inflation rate, real house prices will have corrected by a whopping 28 per cent.

The point being that the starting point for London house prices is not necessarily indicative of a hot market.

4. Construction

The aggregates and asphalt manufacturer: Breedon Group plc

Breedon is one of four national players in the aggregates (quarries) and cement industry.

The quarry industry has a long tail of small and mid-sized regional players, but because of the heavy and low value nature of the products (aggregates, asphalt in particular), the product does not travel far from source.

These dynamics afford the four national players a high local market share.

Being a highly consolidated industry it is a good one in terms of margins and returns in the UK.

It is also important to note that new quarries do not tend to get sanctioned anymore, and are in finite supply.

Supply of aggregates (crushed rock/sand and gravel) in the UK market is actually pretty flat over the past 50 years.

Meanwhile, the cement import market is also controlled by the same large four national players (which include the UK arms of global peers CRH and Holcim).

A number of disruptions and changes have hit the industry in recent years including the sky-high cost of energy, the rising cost of carbon credits, and the need to invest heavily in decarbonisation.

The latter in fact is becoming a pre-requisite to winning large national and regional contracts for road paving, in a market that has previously been dominated by price.

Market forces are pushing the industry to concentrate on the strong scale players; for example those with the cost and scale required to hedge energy cost volatility or with the balance sheet to invest in renewable technologies and fuels.

Breedon is a clear winner in this space (also in terms of leading the decarbonisation drive) and will continue to take share over time.

The UK has a high need for road repair, and the levelling-up agenda and investment in infrastructure will enable continued growth for the sector.

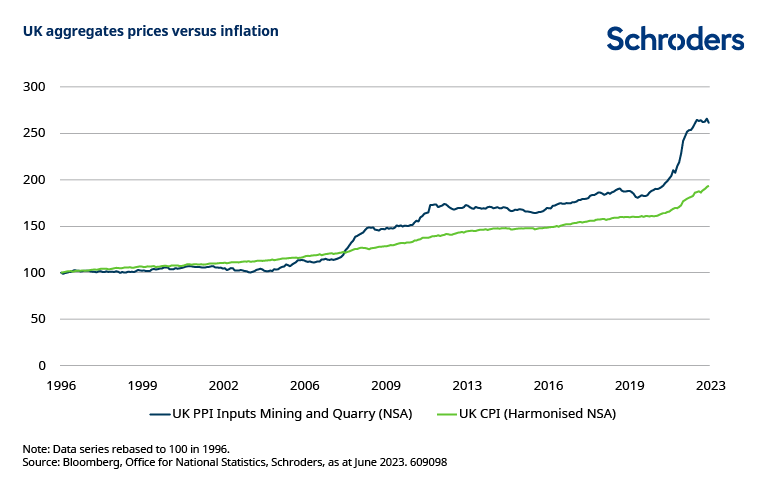

When we invest we look for pricing power as a important ingredient in judging the quality of a company.

Breedon enjoys pricing power in an industry where prices have outstripped broader inflationary trends (see chart below).

5. Real estate

The student accommodation specialist: The Unite Group plc

Unite is the longest serving and leading purpose-built student accommodation (PBSA) provider in the UK.

It is one of very few fully integrated (developer, owner, operator) players in the space, and its scale and integrated model make it the most profitable.

Student accommodation is a specialist industry when it comes to real estate, and a highly focused and customer-centric approach is required to make good returns.

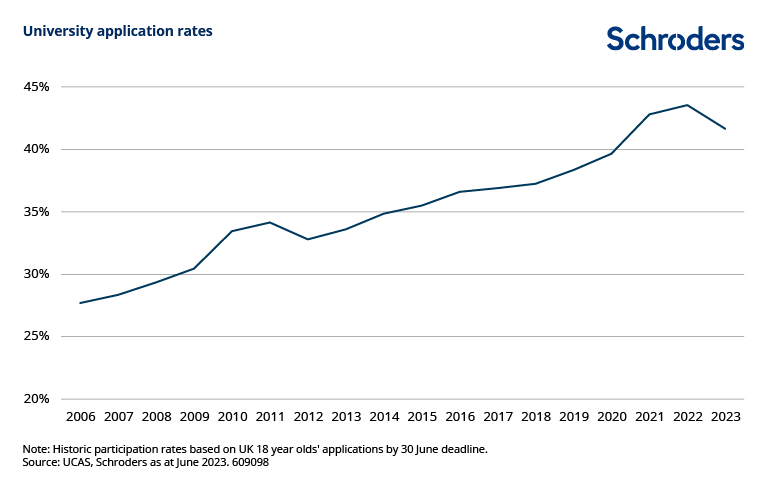

Barriers to entry in the overall provision of accommodation to students are rising rapidly at a time when demand is also rising fast.

Competitors to Unite are the other PBSA real estate investment trusts (Reits), but also the university owned digs as well as the HMO (houses in multiple occupation) market operated by private landlords.

A mixture of both local and national regulations is making it harder to be a private landlord, notwithstanding the higher tax burden and energy efficiency standards.

University budgets are not lined with gold either, and development is being pushed more to providers such as Unite via nomination agreements (long-term offtake contracts between the PBSAs and university groups).

Unite has the relationships and the balance sheet to continue taking a higher share in this growing market.

The ever-rising cost of capital and the shock of the pandemic is also putting paid to new investment in the sector, with pipelines rather thin versus history.

Unite has taken its opportunities well, having invested heavily in the London land market post-Brexit when other investors were pulling back.

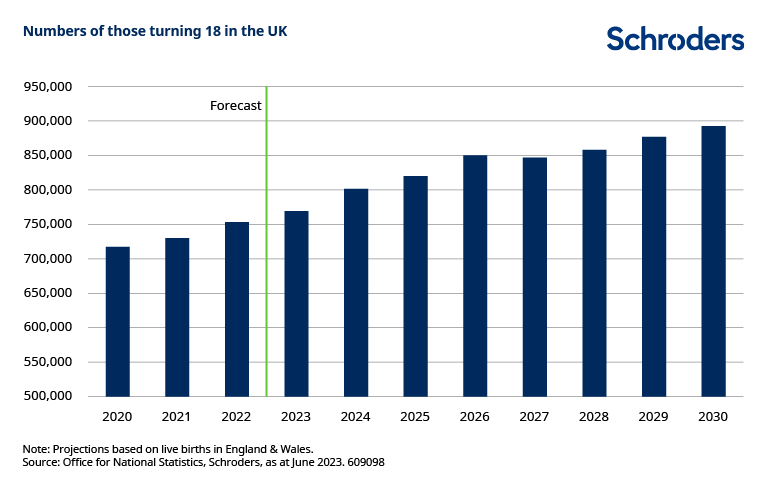

It is very well placed to grow over the next decade where demographics are particularly favourable, as the population of those turning 18 jumps by more than 20 per cent by 2030 (see charts below).

Bill Casey and Nick Kissack are fund managers in UK & European Equities at Schroders

Please note any past performance mentioned is not a guide to future performance and may not be repeated. The sectors, securities, regions and countries shown are for illustrative purposes only and are not to be considered a recommendation to buy or sell.